The Need To Have An Emergency Fund

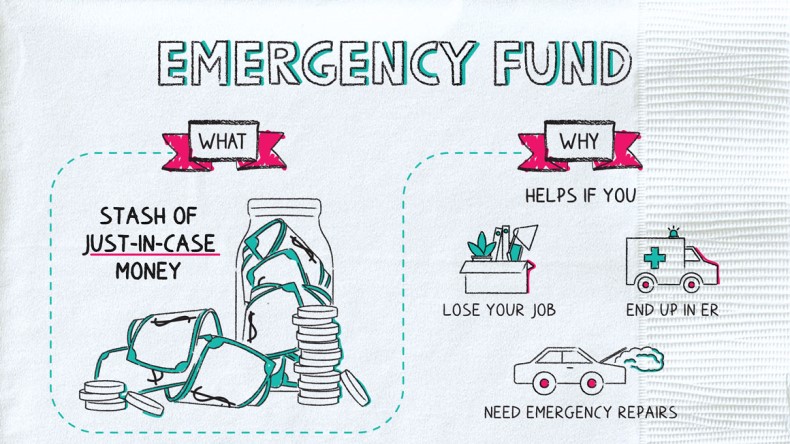

An emergency fund offers individuals the financial safety that they require in life. It is the extra cash set aside to cover emergencies or unexpected situations that might arise at any time. The emergency fund is mainly used during unexpected job losses, emergency medical expenses, home repairs, etc. It ensures that irrespective of the situation, the affected individual can move on with life without struggling with financial troubles. Here’s how setting aside an emergency fund can help individuals:

Acquiring the desired peace of mind:

Knowing that an emergency fund is in place will help individuals acquire the desired peace of mind. They will be able to make different decisions in life more confidently without constantly worrying about what might happen to their finances as a consequence of their choices.

Avoiding debts:

The thought of having some extra cash in hand may sound luxurious. However, no one knows what the future holds. In many cases, people have no choice but to borrow vast amounts of money with higher interest rates to cope with unforeseen situations. So, to avoid such a situation, it is always recommended to have a financial emergency fund in place so that all unexpected problems can be dealt with appropriately.

Ensuring emergency management:

An unforeseen incident can quickly turn a happy family into a mess. It is always recommended to be prepared financially for such a situation to some extent. These situations can be handled much better if sufficient cash is available, and that can only be possible with an emergency fund. The fund will help people cope with the emergency without compromising their financial goals.

Improving financial resilience:

Building an emergency fund can help improve financial resilience. Individuals will no longer have to worry about maintaining financial stability in life. Irrespective of the situation, they can remain assured they have the necessary money to deal with the emergency.

Before building an emergency fund, it is necessary to consider certain factors:

Listing out the monthly expenses:

Everybody should know how much it costs to fulfill basic needs like food, transportation, housing, medications, etc. This will help determine the capacity of the emergency fund.

Understanding the savings needs:

No one can gather all the required money at once. This should be a continuous process to put money aside monthly for emergencies. It offers people clarity over their lives. Individuals can also consider automating their savings every month to reduce additional stress.

Making necessary adjustments to the emergency funds:

Adjusting the savings by periodically assessing emergency needs is very important. This helps maintain flexibility. The individuals will also be able to ensure that their emergency funds are sufficient to cover their living expenses.

Conclusion:

Having extra cash in hand is always essential, especially during emergencies. So, everyone should start planning for emergencies early by building an emergency fund. This emergency fund will not only give them better control over their lives, but they will also be able to deal with difficult situations much better. They will also not depend on others for financial assistance during unforeseen events.