Leveraging E-Commerce Automation for Wealth Growth

Making wise investment decisions is the key to long-term wealth creation in today’s volatile financial landscape. As the financial industry evolves, investors increasingly focus on cutting-edge alternatives. One such promising sector is investing in e-commerce automation. This article delves into the exciting area of amazon automation investments and how they might alter wealth management strategies. By wisely deploying resources to leverage automation’s possibilities, astute investors may discover unrivaled efficiency improvements and revenue growth, propelling their portfolios toward a future of optimal wealth generation.

Understanding E-commerce Investments:

In recent years, e-commerce has grown unparalleled as businesses use digital platforms to reach markets worldwide. This expansion has, coupled with increased automation technology, created an alluring potential for investors to profit from increased production and income. Wealth managers may use automation technologies to build a strong tool that streamlines procedures and boosts revenue.

Navigating the Automation Landscape:

E-commerce automation covers many topics, including data analytics, supply chain management, inventory optimization, and consumer interaction. Investors who are interested in optimizing returns must carefully assess these areas and find automated solutions that support their wealth management goals. Investors may grow exponentially while lowering operational risks by focusing on the correct automation solutions.

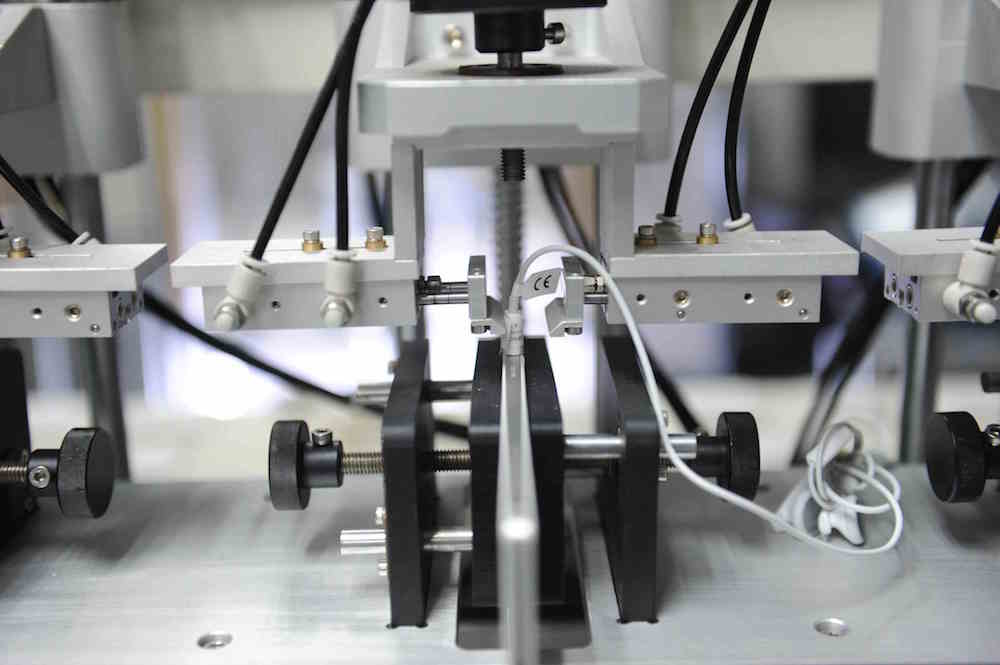

Efficiency Enhancement through Robotics and AI:

The operational dynamics of the e-commerce sector have been completely transformed by integrating robotics and artificial intelligence (AI). For instance, automated warehouses greatly speed up order fulfillment procedures, lower human mistake rates, and improve all aspects of the customer experience. Wealth managers aware of these technologies’ potential might deliberately invest assets to set up their portfolios for robust and long-term development.

Seizing the Data Advantage:

Effective wealth management is based on data, and e-commerce automation provides a lot of priceless information. Automation-driven data analytics enables investors to make well-informed decisions that increase profitability, from examining customer behavior trends to optimizing pricing tactics. Wealth managers that invest in data-centric automation systems can identify significant trends and patterns to remain ahead of market changes.

Mitigating Risks and Ensuring Longevity:

E-commerce automation, like any investment, bears inherent risks. Wealth managers must establish a robust risk-mitigation strategy that includes detailed due diligence, vendor checks, and scalability assessments. Investors may ensure that their automation-driven investments are not only financially sound but also ready to deliver long-term rewards by carefully avoiding potential pitfalls.

Balancing Human Expertise and Automation:

Amazon automation investments have various benefits, and it is vital to strike a balance between technology and human talent. Rather than perceiving automation as a stand-alone solution, wealth managers should see it as a supplement to decision-making. Investors may establish a synergistic method that enhances wealth creation by combining the insights offered by automation with seasoned financial experience.

Conclusion:

Strategic investors must embrace innovation as the wealth management landscape advances to ensure long-term profitability. Amazon automation investments enable wealth managers to increase operational performance, harness cutting-edge technology, and gain data-driven insights.