Cryptocurrency Market: Tips for Traders

Cryptocurrency Market: What is it?

The cryptocurrency market is a virtual platform where transactions of buying, selling, exchanging and storing cryptocurrencies take place. Cryptocurrencies are based on blockchain technology, which provides decentralized, transparent and secure data exchange.

Unlike traditional currencies, cryptocurrencies are not controlled by central banks or governments. They are created and transmitted within decentralized networks. Blockchain is a technology that allows you to store transaction data in a block chain. Each block contains information about a group of transactions and is linked to the previous block. Thus, it becomes almost impossible to change or fake transaction data. There are many different cryptocurrencies. The most famous is Bitcoin, but there are other popular currencies such as Ethereum, Ripple, Litecoin and many more.

There are specialized exchanges for trading cryptocurrencies, such as HTX – https://revieweek.com/review/huobi/, Binance – https://revieweek.com/review/binance/ or OKX – https://revieweek.com/review /okex/ etc. On these platforms, you can buy and sell cryptocurrency, as well as monitor its exchange rate.

Cryptocurrencies are known for their high volatility. This means that their price can fluctuate significantly in short periods of time, which creates both risks and opportunities for traders and investors.

Cryptocurrency Market: Prospects

The cryptocurrency market continues to develop rapidly, attracting the attention of investors, traders and financial experts. The existing and potential prospects of this market remain the subject of lively discussions and forecasts. Consider the key areas of development and potential scenarios:

- Major financial institutions and banks are increasingly integrating cryptocurrencies into their operations. This may accelerate their acceptance as a legitimate and recognized medium of exchange and investment.

- Technological development. The blockchain technologies underlying cryptocurrencies are constantly being improved. This can lead to more efficient, secure, and cheaper systems for exchanging data and value. Traders may also consider utilizing automated tools such as a crypto trading bot to execute trades based on predefined strategies, helping to streamline trading processes and take advantage of market opportunities efficiently

- The issue of regulation of cryptocurrencies remains one of the most relevant. Well-chosen regulatory measures can increase market confidence, while strict or insufficient regulation can stifle its growth.

- Extension of application. Cryptocurrencies are now mostly associated with investment and speculation, but their use as a means of payment is also on the rise. Projects like DeFi (decentralized finance) can dramatically change the financial infrastructure.

- Volatility and risks. Possible regulatory changes, technological innovations, and macroeconomic factors can significantly affect the volatility of cryptocurrencies. This presents both opportunities and risks for traders and investors.

Cryptocurrency Market: Tips for Traders

- Education is the key to success

Continuously learn and follow the market news. The cryptocurrency market is changing rapidly, and keeping abreast of the latest developments will help you make informed decisions.

- Diversify your portfolio

Do not put all your funds on one card. Distribute investments between different cryptocurrencies to reduce risks.

- Define your strategy

Determine if you are a long term investor or prefer short term trading. Each strategy has its own risks and opportunities.

- Use technical and fundamental analysis

Learn the main indicators and tools for market analysis. Fundamental analysis will help you understand the big picture, while technical analysis will help you predict the possible direction of price movement.

- Manage risk

Decide in advance how much you are willing to lose on each trade and set appropriate stop loss orders.

- Avoid emotional decisions

The cryptocurrency market can be very volatile and emotions can get in the way of making objective decisions. Keep your head cool and stick to your strategy.

- Take care of your investment

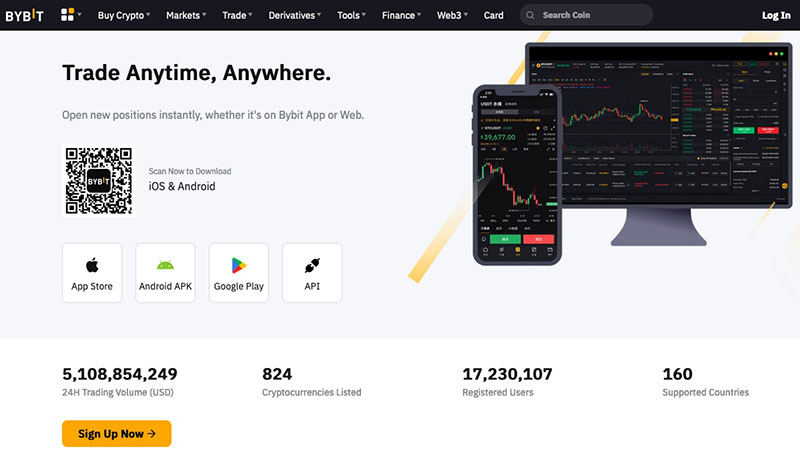

Use reliable crypto exchanges, for example, ByBit – https://revieweek.com/review/bybit/, crypto wallets, activate two-factor authentication and do not keep large amounts on exchange accounts.

- Be prepared for surprises

The cryptocurrency market can change rapidly due to various factors such as regulation, technical issues, or large-scale events in the world.

- Watch out for commissions

When trading frequently, commissions can accumulate quickly. Choose platforms with reasonable rates and keep track of your spending.

- The web is your ally

Join communities, forums and social networks where cryptocurrencies are discussed. Sharing experience and information with other traders can be invaluable.